Only one year after the first assessment of policy-based lending, the Evaluation and Oversight Division commissioned a second one. However, rather than review operational experience as had been done previously, this second exercise was tasked with examining CDB’s overall framework for PBL operations, as a prelude to updating it.

The same individual consultant who had performed the first assessment undertook the second, employing the same methodology of document review and key informant interviews, but this time adding a survey.

Terms of Reference

The consultant’s terms of reference were as follows:

(a)Assess the appropriateness of CDB’s framework for PBL, with attention to:

(i) the existing prudential limit of 20% of total loans outstanding,

(ii) the interest rate structure,

(iii)the use of concessional Special Development Fund (SDF) resources to fund this product and adherence to the SDF strategic objectives,

(iv) the scheduling and role of TA in the design of the PBL and in supporting capacity building and institutional strengthening to achieve the desired results of the PBL

(v)the adequacy of institutional arrangements at CDB

(b)Make recommendations for changes, if necessary, to the framework.

Background and Regional Context

By the end of 2010, the global financial crisis was taking firm hold in the Caribbean region:

- Low or negative rates of GDP growth had characterized many of CDB’s BMCs since the early 1990s, and in 2010 the region as a whole was estimated to have registered a contraction.

- A heavy debt burden derived from several years of weak fiscal performance continued to constrain growth and poverty reduction.

- Weak or declining growth had led to rising unemployment, social pressures exacerbated by rising food and fuel prices, and worsening poverty and social indices.

- Growth was projected to be sluggish until tourism could rebound and was therefore anchored in a recovery in the United States and Europe that remained uncertain for 2011–2012.

It was against this backdrop that the demand for policy-based lending was framed, to both stave off fiscal crisis and facilitate growth-oriented reforms.

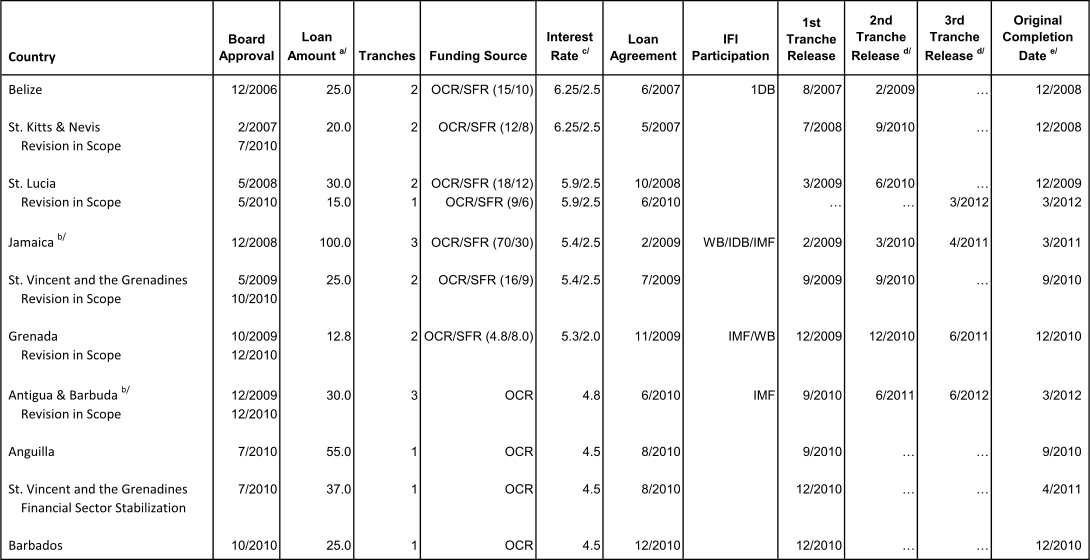

Three new loans had been approved since the previous review, two being single-tranche operations (Table 5.3).

TABLE 5.3: PBLs by the CDB 2006 -2010: Basic Data

Source:CDB

a' In millions of US Dollars

b' Indicates loans composing three equal tranches

c' Two interest rates are quoted. One for OCR one for SFR

d' Actual date or latest estimate

e' Original date by which loan was expected to b fully disbursed. In the case of Jamaica the date refers to the second tranche disbursement

… = not applicable, CDB = Caribbean Development Bank, IDB = Inter-American Development Bank, IFI = international financial institution, IMF = International Monetary Fund, OCR = ordinary capital resources, SFR = Special Funds Resources, WB = World Bank.

Of the 10 PBOs listed in Table 4.3, several experienced delays and performed below expectations. There was an average delay of 6 months between Board approval and the signing of loan agreements. Implementation of loan conditions was delayed because of weak capacity in the BMCs, and unclear objectives and design issues (including, particularly in the earlier PBL operations, an excessive number of conditions in multitranche loans and in situations of rapidly changing economic circumstances). Timely implementation and disbursement were observed in only two of the seven multitranche loans. Disbursements of the remaining five loans were hampered by problems of implementation, with a need for adjustments, waivers, postponements or deferrals, or revisions of scope. By contrast, single-tranche loans were disbursed in a timely manner, without the need for waivers, shortly after finalization of the loan agreements.

Review Findings

Institutional and management arrangements. The review assessed the evolution of CDB’s arrangements to manage PBL and found a number of issues that needed to be addressed:

- The “prudential limit” on policy-based lending of 20% of total loan disbursements had been reached by the end of 2010. CDB either had to severely restrict further lending or raise the limit.

- CDB needed to clarify the role of the IMF and other MDBs if they were to be involved.

- CDB should clarify operating rules for the funding of PBL by OCR or a blend of OCR and concessional resources (a blend of funding should occur only where there was a social sector or poverty reduction component).

- CDB should establish criteria for recommendations to the Board for the approval of waivers, partial disbursements, and revisions of scope.

- Separate and specifically adapted documentation should be prepared for the appraisal, supervision, and review of PBL (rather than relying on existing investment loan procedures).

- The role of CDB in financial sector restructuring needs to be clarified. Experience with bank rescues in two BMCs suggested that restructuring only be done in coordination with other lenders and TA providers.

- Revised guidelines for sectoral PBL operations are needed, including the extent to which, like IDB, CDB plans to develop them to tackle the many challenges in the social sector.

- An appropriate balance needs to be struck between supporting home-grown reforms and undertaking lending operations in which the contribution of CDB is clearly identified.

Conclusions and Recommendations

The review concluded that there was a pressing need for CDB to change its processes given the economic crisis facing the region at the time, and the fact that CDB had reached the 20% PBL lending limit set under the 2005 policy.

After 5 years, important gaps had surfaced in CDB’s framework, indicating that it was no longer adequate to address recent developments in PBL activity or to serve as a comprehensive guide to future PBL operations. There was a need for greater clarity on key aspects, including the review and supervision of PBOs, loan terms, waivers, TA, and the role of partner institutions, such as the IMF and World Bank. Given the uneven performance of PBOs over the first 5 years (as measured by disbursement delays and the incidence of requests for waivers and revisions of scope), the framework needed to be strengthened by updating the policy and operational guidelines.

The review made the following recommendations:

1.Prudential limit and terms

(a)Increase the limit on PBL from 20% to one third of total loans outstanding, with the numerator and denominator measured as a 3-year moving average. Clarify the definition of the limit in the PBL operational guidelines.

(b)Clarify the principles that determine the funding of PBL, and, in particular, the blending of OCR with SDF and OSF.

(c)Apply OCR terms to macro-type PBL operations, and a blend of OCR and concessional funding for PBL operations with a clear poverty-related, social sector, or TA focus.

(d)Given the interest expressed by some BMCs, explore the feasibility of giving borrowers the option of fixed or floating interest rates.12IDB allows borrowers to select one of two interest rate options: (i) a pool-based adjustable lending rate, which is tied to the average cost of a pool of medium- to long-term borrowing, or (ii) a London Interbank Offered Rate (LIBOR)-based lending rate.

2.PBL design and review

(a)Specify, document, and distribute to directors, BMCs, and CDB staff appraisal standards, supervision and management review practices, and evaluation criteria that are specific to PBL operations, including those, such as the recent PBL for Barbados, that are based on an assessment by the CDB of the quality of policies and actions which are fully implemented by BMCs before completion of the appraisal.

(b)Extend the period between loan approval and the signing of the PBL agreement beyond the current maximum limit (60 days) only in cases where the Loans Committee is satisfied that an extension would not result in a substantively changed macroeconomic framework or outlook for the BMC than that discussed at the time of board approval.

(c)Document the procedures and review criteria used by the Loans Committee in the conduct of its assessment and approval of PBL proposals from the staff.

(d)On the completion of each PBL operation, prepare completion reports to facilitate institutional learning and adequate evaluation.

(e)Include a quantitative assessment of the impact of each PBL on the borrower’s debt in the PBL documents sent for approval to the Loans Committee and the Board.

3.Variations of PBL

(a)Since macro-type and sectoral PBL operations were contemplated in the policy approved by CDB’s Board, but no sectoral loan has been developed, clarify the operational differences between macro-type and sectoral PBL, with examples of what would constitute a sectoral PBL, and how such a PBL would be managed—including for operations in the public, financial, and social sectors.

(b)Clarify the policy and practice regarding the role of the IMF, World Bank, and IDB as partners in PBL operations.

4.Waivers, revisions in scope, and disbursements

(a)Incorporate into the PBL guidelines the policies and practices regarding waivers, deferrals, and revisions of scope, including a clarification of the roles of the Board, the President, and the Loans Committee.

(b)Set out guidelines governing partial disbursements and supplementary financing.

(c)Include in the operational guidelines the process for communicating to BMCs CDB’s decisions on tranche disbursements.

5.TA and coordination with other lenders and donors

(a)Revise the guidelines to require: (i) early consultation with other lenders and donors on ongoing and planned PBL operations and related TA issues; and (ii) a summary of these discussions in the appraisal document.

(b)Specify more clearly in loan proposals to the Board an assessment of the TA (if any) needed to achieve the objectives of each PBL, the scheduling and delivery of such TA by institution, and the specific contribution of the CDB, including through TA loans or grants.

- 12IDB allows borrowers to select one of two interest rate options: (i) a pool-based adjustable lending rate, which is tied to the average cost of a pool of medium- to long-term borrowing, or (ii) a London Interbank Offered Rate (LIBOR)-based lending rate.