Over the past 14 years, CDB undertook 27 operations (as of September 2020) amounting to $944.7 million. In 2019, PBL represented 42% of CDB’s total loan approvals and 54% of its loan disbursements. PBL has financed emergency priority spending and helped preserve stability in BMCs, which are highly vulnerable to external shocks and natural disasters. This vulnerability6A CDB working paper argued that its borrowing member countries (BMCs) are, on average, medium to highly vulnerable countries. CDB. 2019. Measuring Vulnerability: A Multidimensional Vulnerability Index for the Caribbean. CDB Working Paper 2109/01. derives from inherent structural characteristics such as lack of economies of scale, export concentration, remoteness from global markets, lack of economic diversification, dependence on external financing, and exposure to natural hazards and climate change. Acevedo Mejia7Sebastian Acevedo Mejia. 2016. Gone with the Wind: Estimating Hurricane Climate Costs in the Caribbean. IMF Working Paper WP/16/199. Washington, DC: IMF. notes that Caribbean countries are seven times more likely than other countries to be affected by a natural hazard, and to suffer damage that is six times greater.

CDB’s PBL activity can be separated into two distinct periods. The first generation of lending was prepared under the original 2005 policy framework. PBL activity rose sharply in 2008–2010 coinciding with the adverse social and economic fallout from the global financial crisis of 2007–2010. Multitranche PBL provided urgently needed financing, supported the restoration of macroeconomic and fiscal stability, and strengthened debt dynamics in the wake of the crisis. The second generation of PBL operations was based on the revised policy framework introduced in 2013, with a high proportion being crisis-response PBL.

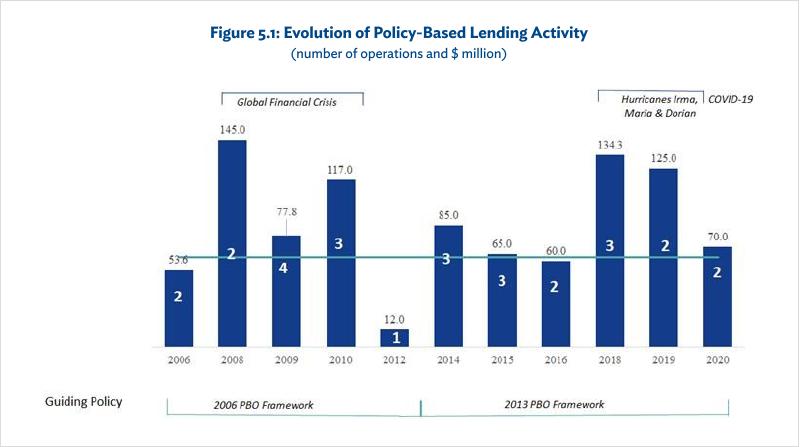

During the period 2006–2020,8Data for the year 2020 cover the months January–September. PBL activity correlated closely with periods of economic and natural hazard shocks (Figure 5.1). CDB approved nine PBOs totaling approximately $340 million (36% of the PBL portfolio) on the heels of the global financial crisis in 2008. Given the increasing frequency and intensity of hurricanes in the region, PBL demand has remained strong since 2015, peaking in the 2017 and 2019 hurricane seasons. The extensive damage from hurricanes Irma and Maria to Dominica and Anguilla in 2017 contributed, in part, to some of the PBL lending in 2018. CDB also supported the government of Bahamas in 2019 with an exogenous shock response programmatic PBL ($50 million) to address the fallout related to Hurricane Dorian.

COVID = coronavirus disease, PBO = policy-based operations.

Source: Caribbean Development Bank.

CDB’s ordinary capital resources (OCR) provide 86% of the resources for PBL, with concessionary resources from the Special Development Fund (SDF) (Unified) providing 10% and Ordinary Special Funds 4%. Lending rates and tenors for concessional resources have been determined differently for different country groups, according to levels of gross domestic product (GDP) per capita. Higher lending rates combined with shorter tenors and therefore lower degrees of concessionality have been targeted at higher-income countries which have traditionally had greater market access for financing. Conversely, lower-income countries have accessed SDF resources blended with OCR for greater concessionality of lending.

- 6A CDB working paper argued that its borrowing member countries (BMCs) are, on average, medium to highly vulnerable countries. CDB. 2019. Measuring Vulnerability: A Multidimensional Vulnerability Index for the Caribbean. CDB Working Paper 2109/01.https://www.caribank.org/publications-and-resources/resource-library/working-papers/measuring-vulnerability-multidimensional-vulnerability-index-caribbean

- 7Sebastian Acevedo Mejia. 2016. Gone with the Wind: Estimating Hurricane Climate Costs in the Caribbean. IMF Working Paper WP/16/199. Washington, DC: IMF.

- 8Data for the year 2020 cover the months January–September.