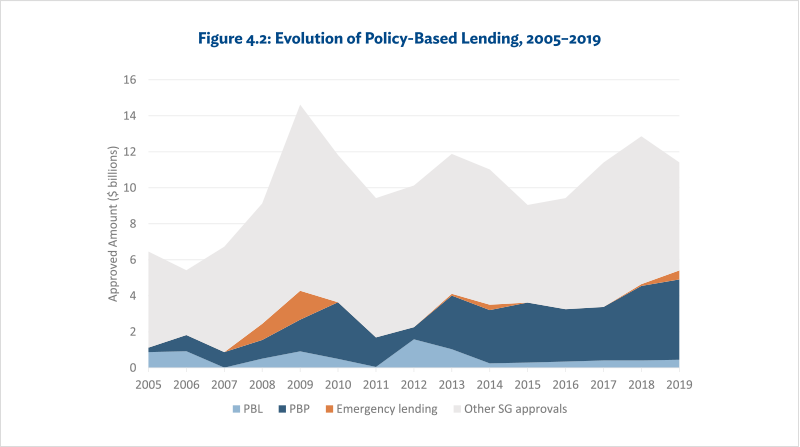

Between 2005 and 2019, policy-based operations accounted for 28% of IDB’s sovereign-guaranteed approvals4Sovereign guaranteed approvals in this context includes all SG loan and guarantee operations regardless of funding source., with the share increasing over time. In this period, IDB approved 266 policy-based operations totaling almost $42.6 billion. About 80% of these resources were approved as programmatic operations supporting 124 programs, with the remaining 20% as individual single- or multitranche policy-based operations. Since 2007, programmatic PBLs have consistently accounted for at least three-quarters of all approved policy-based operations. Policy-based operations’ share of total sovereign guaranteed approvals increased from 19% in 2005–2009 to 36% in 2015–2019 (Table 4.2). The 2007–2009 global financial crisis led to a significant increase in the number and amounts of policy-based operations. IDB approved 61 policy-based operations for $7.9 billion in 2008–2010, compared with only 31 such operations for $3.8 billion during the previous 3 years. After falling somewhat in relative importance in 2011–2012, policy-based operations rose again in 2013 and since then IDB has averaged around 19 policy-based operations totaling almost $3.9 billion per year (Figure 4.2).

PBL = policy-based loan, PBP = programmatic policy-based loan, SG = sovereign-guaranteed.

Source: IDB Office of Evaluation and Oversight(OVE), based on data from IDB databases.

Emergency lending accounted for 2% of sovereign-guaranteed approvals between 2005 and 2019. Emergency lending to provide financial support during a macroeconomic crisis was primarily used during the 2007–2009 financial crisis. Five countries used this option, but three of the loans never disbursed and two disbursed only partially. Three countries also made use of emergency lending after the financial crisis to weather country specific crises (Table 4.1). Overall, IDB approved $3.5 billion in emergency lending between 2005–2019, of which 71% was approved in 2008-09.

Table 4.1. Emergency Lending, 2005–2019 ($ million)

Source: IDB Office of Evaluation and Oversight(OVE), based on data from IDB databases.

IDB’s PBL and emergency approvals spiked during the first half of 2020, in response to the COVID-19 pandemic and its economic effects. To facilitate timely approval of operations to help its borrowing member countries respond to the COVID-19 pandemic and related social and economic effects, IDB developed several prototype operations, including one for PBL in support of fiscal and economic management to help cushion the effects of the economic crisis. The PBL prototype sets out a menu of policy measures geared towards timely availability of resources to respond to the public health crisis, temporary expansion of social protection programs, provision of essential services, efficient public expenditure management and formulation of a program for economic recovery. Individual operations then draw on a menu of these measures for speedy preparation and approval. The prototype also includes a pro forma results matrix. During the first 7 months of 2020, IDB approved 14 PBL operations amounting to $4.18 billion, of which $1.2 billion went to five prototype operations. In addition, it approved five special development lending operations in the amount of $1.2 billion.

Cofinancing of IDB PBL has been minimal since the mid-2000s. Most of IDB’s PBL cofinancing occurred in the early days of PBL, especially in the first 2 years of the instrument’s existence when partnership with the World Bank was mandatory. Cofinancing remained important until the mid-2000s but since then IDB has financed almost all PBL on its own. Similarly, in the early years of PBL, operations used to be approved when the borrowing country had an IMF-supported program in place: 90% of the PBL approvals between 1995 and 2003 were granted to countries with an IMF program. This proportion has decreased substantially since then, both because of the decreasing presence of IMF-supported programs in Latin America and the Caribbean, and because of IDB’s progressive move to expand its own assessment of the adequacy of countries’ macroeconomic frameworks and reduce its dependence on the IMF’s views. There are, nevertheless, instances where IDB has continued to support PBL in the context of an IMF program, including for example $1 billion of PBL support to Argentina in 2018–2019.

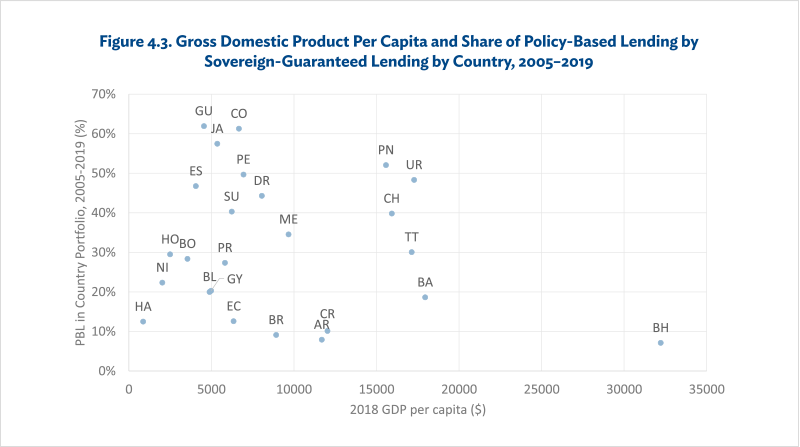

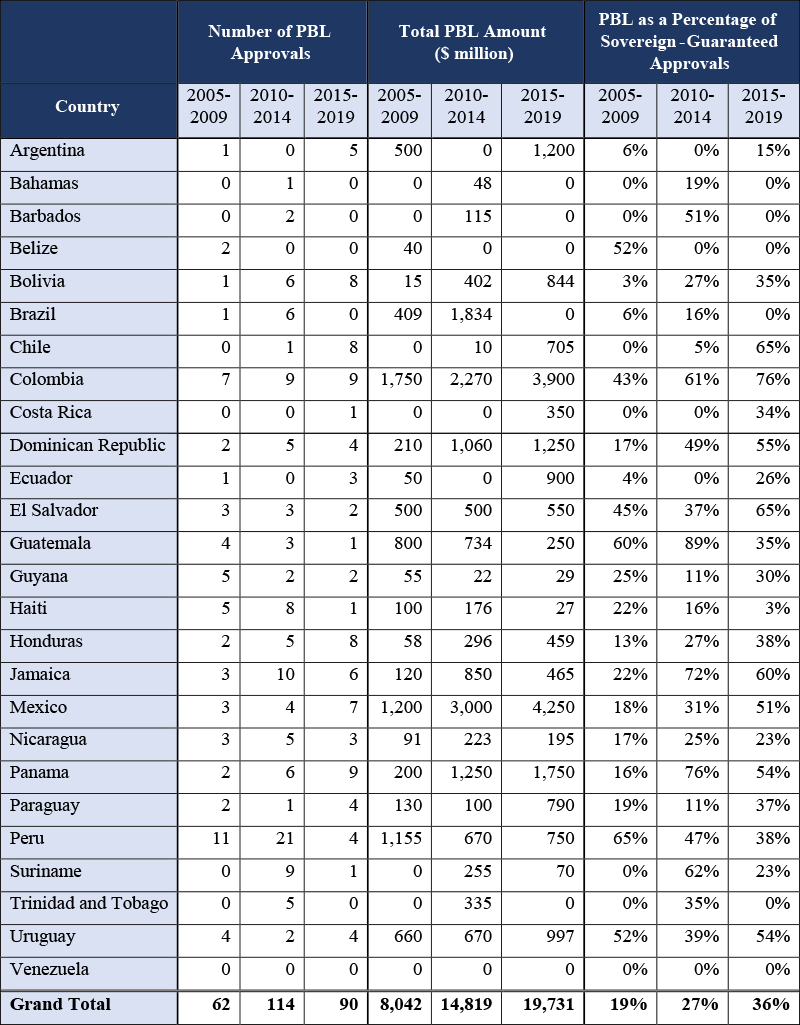

Apart from Venezuela, all borrowing member countries made use of PBL over 2005–2019, but the relative importance of PBL in country portfolios varied. The share of PBL in overall sovereign-guaranteed approvals increased for all country income groups and was not significantly correlated with country income level (Figure 4.3 and Annex, Figure 4.A2). In terms of overall importance, a few countries have dominated, both in the number and amounts of PBL received. Peru received 36 PBL operations and Colombia 25, reflecting their strong preference for the instrument. In terms of overall volume, Colombia and Mexico together accounted for almost 40% of the approved PBL volume over this time period (Table 4.2). Five countries (Colombia, Guatemala, Jamaica, Panama, and Peru) borrowed at least half of their sovereign-guaranteed envelope in the form of PBL in 2005–2019, and in the last 5 years eight countries did so (Chile, Colombia, Dominican Republic, El Salvador, Jamaica, Mexico, Panama, and Uruguay). Only two countries (Peru and Uruguay) have made use of the deferred draw-down option, with Uruguay using it as an important instrument for fiscal and foreign exchange management.

GDP = gross domestic product, PBL = policy-based lending. AR=Argentina; BH=Bahamas; BA=Barbados; BL=Belize; BO=Bolivia; BR=Brazil; CH=Chile; CO=Colombia; CR=Costa Rica; DR=Dominican Republic; EC=Ecuador; ES=El Salvador; GU=Guatemala; GY=Guyana; HA=Haiti; HO=Honduras; JA=Jamaica; ME=Mexico; NI=Nicaragua; PN=Panama; PR=Paraguay; PE=Peru; SU=Suriname; TT=Trinidad and Tobago; UR=Uruguay.

Source: IDB Office of Evaluation and Oversight (OVE), based on data from IDB databases.

Table 4.2. Policy-Based Lending Approvals by Country, 2005–2019

Notes: PBL = policy-based lending. Includes PBL funding from all sources.

Source: IDB Office of Evaluation and Oversight (OVE), based on data from IDB databases.

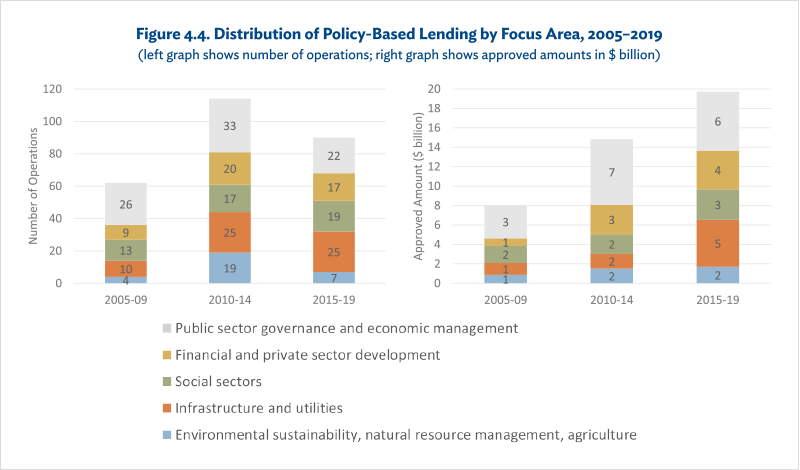

IDB classifies its loans based on their main sector focus. Based on this classification, this chapter has grouped the PBL approvals in 2005–2019 into five thematic areas:

(i)public sector governance and economic management;

(ii)financial sector reform and private sector development (with the latter mostly supporting measures to improve competitiveness);

(iii)social sectors (health, education, social protection and gender);

(iv) infrastructure and utilities (transport, energy, water and sanitation, housing and municipal infrastructure); and

(v) environment, natural resource, territorial and disaster risk management, and agriculture.

Both in terms of number of operations (30% of the total) and approval volumes (38% of the total), PBL in the area of public sector governance and economic management has dominated.5Some PBL operations support reforms in multiple sectors. When assigning a sector code to an operation, IDB goes by the number of policy measures in a given sector and does not account for the fact that operations may cover several sectors. Hence the figures presented here may not give a full picture of all reforms supported in a given area.The importance of reforms supported in this area grew considerably in the face of the 2007–2009 global financial crisis. However, an analysis by the IDB Office of Evaluation and Oversight (OVE) found that the content of policy conditions did not change much compared with similar PBL operations approved before the crisis. Programs initiated in pre-crisis years (2005–2007) and crisis years (2008–2010) included similar conditions, which were usually oriented toward such areas as establishing fiscal rules, increasing government revenues or improving spending, and developing frameworks and systematic macroeconomic forecasting for budgeting.6IDB Office of Evaluation and Oversight, Design and Use of Policy-Based Loans at the IDB. Document RE-485-6. Washington, DC: https://publications.iadb.org/en/ove-annual-report-2015-technical-note-design-and-use-policy-based-loans-idbIDB

The second most important group contained PBL in support of infrastructure, with a particular focus on utility reforms, which accounted for 23% of operations and 18% of lending volume. This group grew considerably in importance over the review period, from only ten operations approved in 2005–2009 to 25 operations in 2015–2019, driven by support for energy sector reforms.

A more in-depth analysis of PBL by OVE suggests that IDB usually supports reform processes in areas in which it has accumulated experience and knowledge. In its 2015 review of the design and use of PBL at IDB, OVE mapped the interaction between PBL and a set of broader but related operations in each country, using social network analysis. The results suggested that IDB tended to support policy reforms in sectors in which it had previously worked (usually through technical cooperation grants or investment loans) and thus where it had some country-level expertise that allowed it to sustain policy dialogue and provide relevant technical advice. This finding is also compatible with the hypothesis that when countries need quick financial support, IDB turns to sectors where it has expertise so it can respond more quickly.

Source: IDB Office of Evaluation and Oversight(OVE), based on data from IDB database.

- 4Sovereign guaranteed approvals in this context includes all SG loan and guarantee operations regardless of funding source.

- 5Some PBL operations support reforms in multiple sectors. When assigning a sector code to an operation, IDB goes by the number of policy measures in a given sector and does not account for the fact that operations may cover several sectors. Hence the figures presented here may not give a full picture of all reforms supported in a given area.

- 6IDB Office of Evaluation and Oversight, Design and Use of Policy-Based Loans at the IDB. Document RE-485-6. Washington, DC: https://publications.iadb.org/en/ove-annual-report-2015-technical-note-design-and-use-policy-based-loans-idbIDB